- 18 May, 2020

- Economy and Energy

In early April, Gazprom Armenia applied to the Public Services Regulatory Commission with a request to reconsider gas distribution tariffs. In particular, it is proposed to increase the average tariff by 11% and set it at 136 AMD instead of the current 122 AMD per cubic meter.

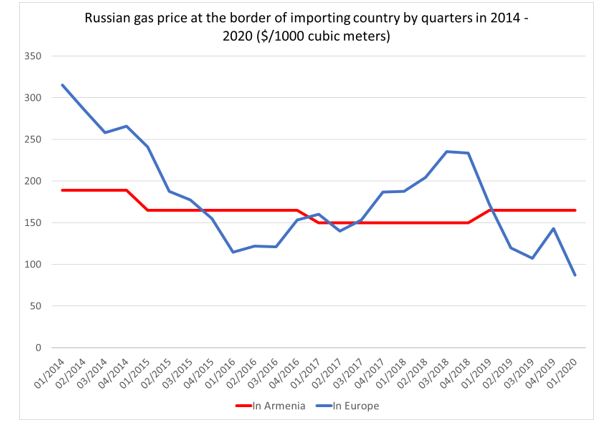

In the light of this request, and given the unprecedented drop in Russian gas price in Europe, the Union of Informed Citizens decided to publish some indicators of the dynamics of gas price after the signing of the “Gas Agreements”, comparing it with the price of Russian gas supplied to Europe.

The contractual base

On December 2, 2013, the famous “gas” agreement was signed in Yerevan, which had two components: an agreement on the sale and operation conditions of ArmRusGasArd shares, as well as an agreement on the procedure of gas pricing.

According to the first agreement, the last 20% of ArmRusGasArd shares were transferred to Gazprom, and, in fact, it was guaranteed that the Armenian side will buy gas from Gazprom until the year 2043, and Gazprom Armenia even received a right of priority in exporting electricity.

The second agreement fixed the price of gas delivered to Armenia at the border until December 31, 2018. Initially, it was 190 USD per 1,000 cubic meters, then it became 165 USD, and later was reduced to 150 USD (the Armenian side granted Gazprom Armenia further privileges for these reductions).

The price at the border

The 2013 agreement was signed for five years, and was valid until January 1, 2019. From that day on, as a result of negotiations, the price of gas at the border was temporarily (and to date) fixed at 165 USD per 1,000 cubic meters.

In 2014, 190 USD was a beneficial price for Armenia compared to international market prices. However, over time, Russian gas price significantly dropped in the European market, and the gas quickly became more expensive for Armenia (Gazprom Armenia) compared to the price for the same gas delivered to Europe.

As of the first quarter of 2020, the average price of Russian gas delivered to Europe (at the border) is about 87 USD, and at the Armenian border it is 165 or almost twice as expensive as in Europe.

Moreover, the decline in Russian gas price in Europe began even before the Coronavirus pandemic. In the third quarter of 2019, it was already cheaper than in Armenia, and in April 2020, the price of Russian gas in Europe was about $ 59 per 1,000 cubic meters.

The distribution cost

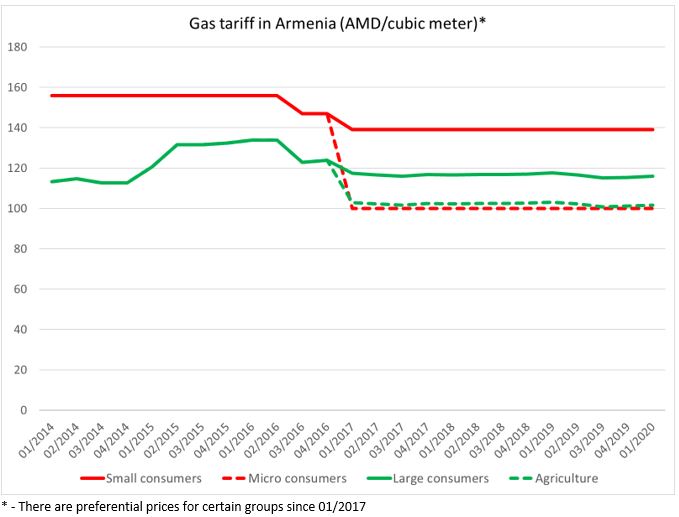

However, these were the prices at which Gazprom Armenia purchases gas from Gazprom. In turn, Gazprom Armenia sells gas at tariffs set by the PSRC. Since 2014, the price of gas for household consumers (when expressed in AMD) has only decreased, and for consumers of more than 10,000 cubic meters per month, it first increased (due to the devaluation of the AMD) and then decreased.

* – There are preferential prices for certain groups since 01/2017

Moreover, since 2017, preferential prices have been set for some types of agricultural activity and for consumers using less than 600 cubic meters per year, which are dotted in the graph.

According to the agreement signed in 2013 for a term of 30 years, the tariffs set by the PSRC shall ensure that Gazprom Armenia covers its spending on gas purchase at the border and gas distribution (and “brings back” investments), and has an average annual profit of 9 percent.

In other words, in 2014, Gazprom Armenia received 36 AMD from the distribution of 1 cubic meter of gas to large consumers, and 79 AMD from the distribution to household consumers, while currently those figures make up 37 AMD for large consumers (23 AMD for some branches of agriculture) and 60 AMD ( for very few consumers – 21 AMD).

Currently, Gazprom Armenia has a margin of 43 AMD from the distribution of 1 cubic meter of gas. In the price reconsideration request, it is proposed to increase it by 14 AMD (or 32 percent) and make it 57 AMD. However, this number is even higher than the 2014 gas distribution margin after the signing of the “gas” agreements.

Thus…

The record low gas margin may not be enough to ensure the 9% profitability stipulated in the 2013 agreement, which is why Gazprom Armenia has applied for a tariff revision. However, it cannot be ruled out that it will be possible to reduce the costs of Gazprom Armenia within the scope of the discussion on the validity of gas distribution costs and ensure that Gazprom Armenia has 9% profit within the limits of the existing low margin (or increase the margin by lower amount rather than the proposed 14 AMD).

However, the figures shown demonstrate that, unlike in 2014, the incomprehensibly high price of gas at the border is largely responsible for the price of gas (with possibly increase) paid by the end consumer in Armenia.

The agreements signed in 2013 and the monopolies granted to Gazprom really limit the opportunities for the Armenian government to influence the price of gas at the border, making the issue subject to Armenian-Russian political dialogue.

Daniel Ioannisyan, Sevada Ghazaryan

Union of Informed Citizens