- 23 January, 2020

- Economy and Energy

On December 2, 2013, the famous “gas” agreement was signed in Yerevan, which had 2 components: an agreement on the conditions of sales and operation of “ArmRusGasArd” shares, as well as an agreement on the procedures of the formation of gas prices. Weeks later, the National Assembly ratified the treaties, despite attempts by Nikol Pashinyan and Zaruhi Postanjyan to hinder the process, as well as those of journalists protesting in the Assembly and demonstrators in Baghramyan avenue.

Recently it became known that Gazprom Armenia is likely to submit a request to the Public Services Regulatory Commission (PSRC) to raise the gas tariff in Armenia. In the light of this information, the Union of Informed Citizens decided to publish some indicators of gas price dynamics following the “gas” agreements.

The price at the border

By the first agreement,the last 20% of ArmRusGasArd shares were transferred to Gazprom, and, in fact, it was guaranteed, that by 2043 the Armenian side will buy gas from Gazprom, and Gazprom-Armenia even received advantages in exporting electricity.

The second agreement fixed the price of gas delivered to Armenia at the border by December 31, 2018. Initially, it was 190 USD per 1,000 cubic meters, then it became 165 USD and then was reduced to 150 (Armenian side granted Gazprom Armenia more privileges for these reductions). However, th2013 agreement was signed for five years, and ceased to be effective on January 1, 2019. Since that day, as a result of negotiations, at the border, the price of gas was temporarily (and to date) fixed at 165 USD per 1,000 cubic meters.

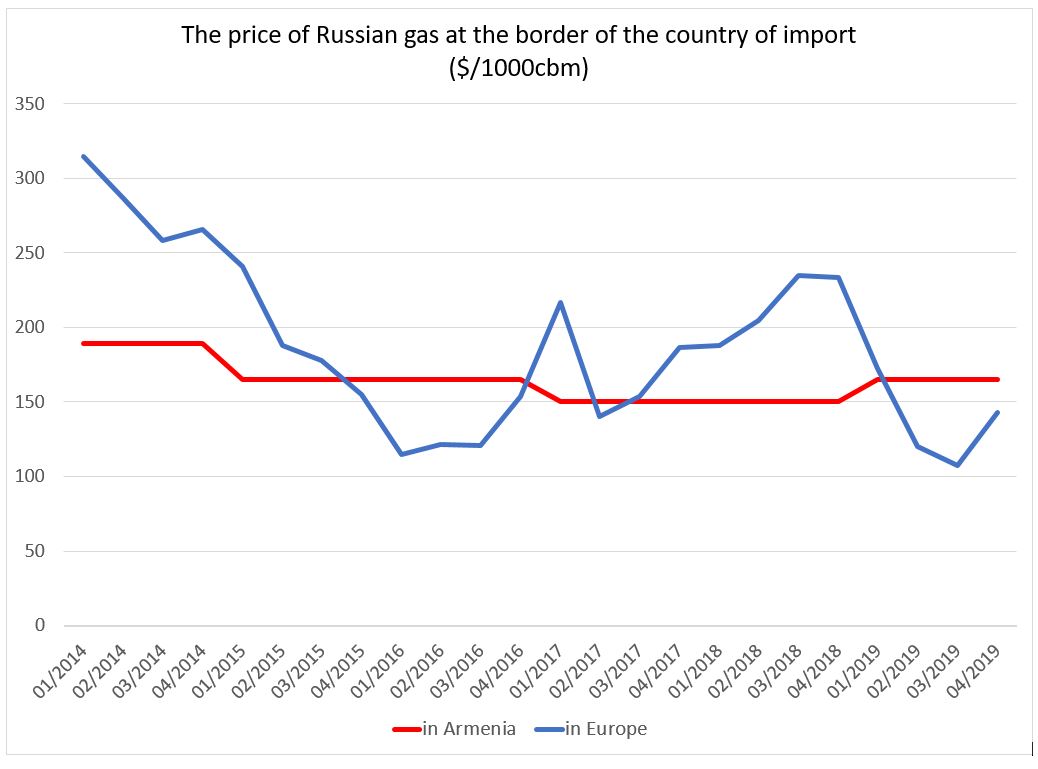

However, if in 2014, 190 USD was a profitable price for Armenia compared to international market prices, over time, Russian gas became significantly devalued in the European market, and eventually the gas was more expensive for Armenia (Gazprom Armenia) than for Europe.

The price of Russian gas at the border of the country of import ($/1000cbm)

For example, as of the fourth quarter of 2019, the average price of Russian gas delivered to Europe was about 139 USD (at the border), while on the Armenian border, it was 165 USD, as mentioned, which is 19% more than the price set for Europe.

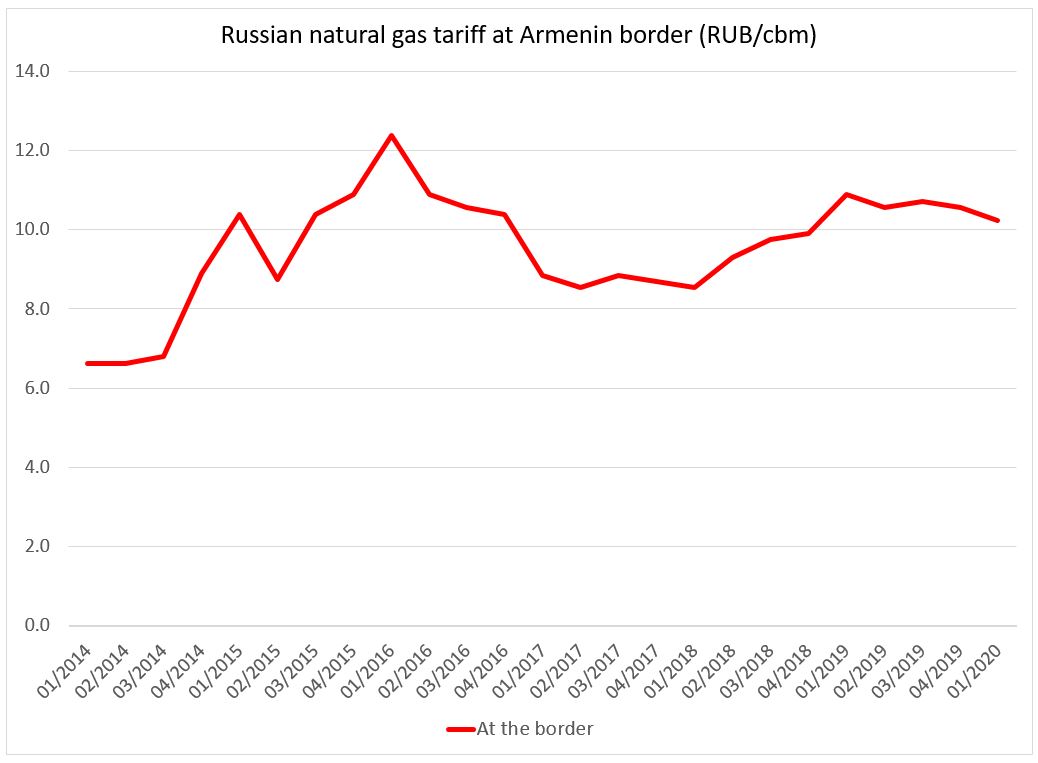

Moreover, if we take into account that Russian Gazprom makes most of the gas export expenses in rubles , then it is worth exploring, how much gas costs on the Armenian border not only in US dollars but in the currency of the exporting country (in Russian rubles).

The graphic clearly shows, that Gazprom’s profit per cubic meter of gas supplied to Armenia has increased substantially from 6.6 to 10.2 rubles compared to 2014.

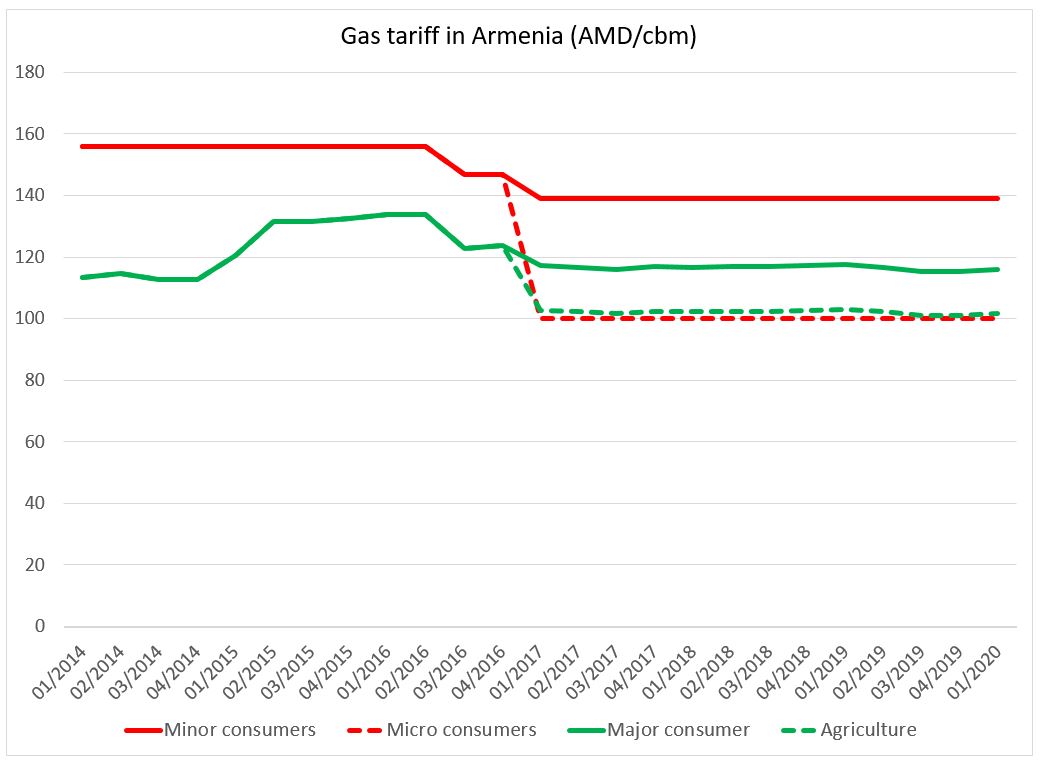

Distribution value

The above described, however, were the prices at which Gazprom Armenia purchases gas from Gazprom . Gazprom Armenia, for its part, sells gas at tariffs set by the PSRC. Since 2014, the price of gas for residents in monetary terms has only decreased, and for consumers of more than 10,000 cubic meters per month, it first increased (due to the devaluation of the currency) and then decreased.

Moreover, since 2017, privileged tariffs have been set for some agricultural sectors and for consumers using less than 600 cubic meters per year, which are dotted in the graph.

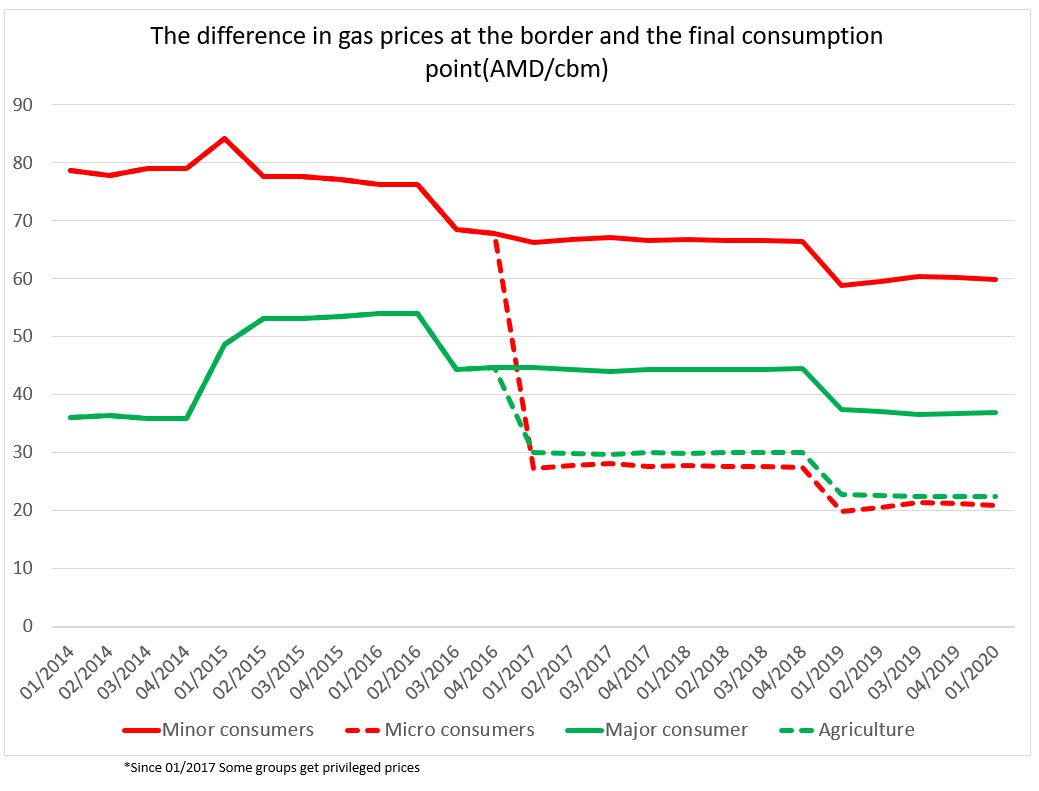

Tariffs set by PSRC, according to the 30-year agreement signed in 2013, should be such that Gazprom Armenia covers its costs of purchasing and distributing gas at the border (including “back up” investments) and having a 9% annual average return.

So, if we try to see what the margin was and what the difference in marginal gas price would be to the end-user, we will have the following picture.

That is, if in 2014 Gazprom Armenia received 36 AMD from major consumers and 79 AMD from residential customers for distribution of 1 cubic meter of gas, now those numbers are 37 AMD for large consumers (for some branches of agriculture – 23 AMD) and 60 AMD for residential customers (21 AMD for very few consumers).

In other words, it is clearly seen, that the gas margin in Armenia has fallen sharply. Moreover, since January 2019 (when the price of gas at the border increased from150 to 165 USD ) that margin has declined even more.

Thus

The low record of gas margin may not be enough to ensure 9% profitability under the contract signed in 2013, and this is exactly why Gazprom Armenia intends to apply for a tariff review. Although, it is not excluded that within the scope of discussing the justification of gas distribution costs it may be possible to reduce Gazprom Armenia’s expenses, and at an existing low margin, the company would have a 9% profit.

Though, the shown figures justify that, unlike 2014, at present, in Armenia, the gas price (and its possible increase) to the end-user in Armenia is largely driven by the unusually high price of gas at the border.

The agreements signed in 2013 and the monopolies granted to Gazprom really reduce the opportunities for the Armenian government to influence the price of gas at the border making the issue the subject of Armenian-Russian political dialogue.

Daniel Ioannisyan

Union of Informed Citizens